nassau county tax grievance status

Nassau County residents should file a tax grievance each and every year. Request must be made to the BAR or to the assessor on or before grievance day and the BAR must set a date no later than 21 days after grievance day for the hearing.

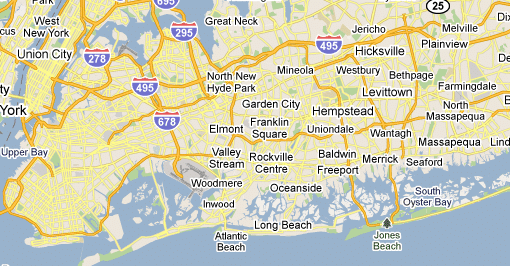

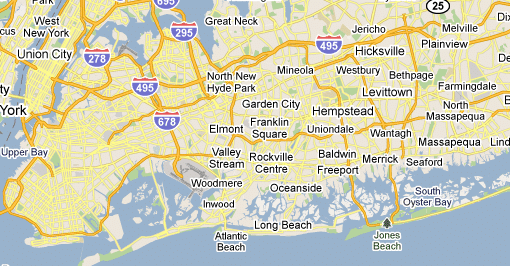

Property Taxes In Nassau County Suffolk County

School taxes range from 1068 to 4263 per 1000 of full market value without considering STAR program benefits.

. For the last 18 years he has. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. 631 302-1940 Nassau County.

If you have selected a professional firm such as Maidenbaum to represent your interests you will be periodically notified of the status of your grievance. At the request of Nassau County Executive Bruce A. Nassau Countys official website specifically states that The Assessment Review Commission will never increase the assessment which means that your decision to grieve your property taxes has zero risk associated with it.

The Nassau County sales tax rate is 425. Its free to sign up and bid on jobs. The New York state sales tax rate is currently 4.

The Nassau County sales tax rate is 425. If youve already received a marketing piece from us you can simply access your personal webpage and follow the instructions to sign up. Without accounting for exemptions the Nassau property tax rate is 515 per 1000 of full value in 2021 plus town taxes of 003 to 1805.

The New York state sales tax rate is currently 4. Search for jobs related to Nassau county tax grievance status or hire on the worlds largest freelancing marketplace with 20m jobs. Welcome to AROW Assessment Review on the Web.

If you file for yourself you may check your appeals status on-line at any time. Let us do all the work for you. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

All Live ARC Community Grievance Workshops. If youve chosen us to represent you feel free to email. If I file a tax grievance Nassau County tax officials will.

You may also look up the status of appeals for past tax years. To file an appeal and start using Assessment Review on the Web click on the link below. A non-resident owner can request a date after Grievance Day for the grievance hearing but must submit Form RP-524 on or before the regularly scheduled Grievance Day.

Thats not the case in New York State or in Nassau County. March 2 property tax rates in new york especially in suffolk and nassau counties are among the highest in the nation. For the 20232024 tax year a successful assessment reduction may be reflected in 3 possible ways.

The New York State Real Property Tax Law as amended by Chapter 957 of the Laws of 1970 added Article 15A-title one County Services to Cities and Towns Article 15A requires that each county excepting Nassau Tompkins Rockland and the five counties that make up the City of New York maintain a Real Property Tax Services Agency. Hiring Maidenbaum to file a Nassau County tax grievance on your behalf is quick and easy. The median Nassau County tax bill was 14872 in 2019.

This is the total of state and county sales tax rates. This is done by filling out an application and submitting it with any supporting documentation to the Nassau County Assessors Office. 631 302-1940 Nassau County.

A plan to phase in nassau countys reassessment over five years to allow tax hikes to take effect gradually is stalled in the county legislature amid a standoff between majority republicans and. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing Period to May 2 2022 The Assessment Review Commission - ARC - acts on. This is the total of state and county sales tax rates.

Nassau County residents have a right to file a property tax grievance if they feel that the assessed value of their property has been incorrectly determined. If you file for yourself you may check your appeals status on-line at any time. How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island Otherwise you are paying too much in property taxes.

At the request of Nassau County Executive Bruce A. If not you can request an authorization by clicking here. If you have selected a professional firm such as Maidenbaum to represent your interests you will be periodically notified of the status of your grievance.

Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners. Nassau county tax grievance status. Request Your Tax Grievance Form Today.

When Will My Assessment Reduction Appear on My Tax Bills. File an appeal between January 3 2022 and March 1 2022 or view pending and past appeals. Given that multiple years tax challenges can be occurring at the same time Maidenbaum sends fully personalized summary letters explaining the status of each challenge.

This website will show you how to file a property tax grievance for you home for FREE. We will keep you posted on the status of your tax grievance and any change in the status of your case andor settlement offer from the County in a timely manner.

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Rich Varon Nassau County Tax Grievance Facebook

District 16 Arnold W Drucker Nassau County Ny Official Website

Tax Grievance Appeal Nassau County Apply Today

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Nassau County Property Tax Reduction Tax Grievance Long Island

5 Myths Of The Nassau County Property Tax Grievance Process

Nassau County Grievance Filing On Property Tax Property Tax Grievance Heller Consultants Tax Grievance

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Tax Grievance Deadline 2023 Nassau Ny Heller Consultants

Nassau County Tax Grievance Property Tax Reduction Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

All The Nassau County Property Tax Exemptions You Should Know About

Nassau County Property Tax Reduction Tax Grievance Long Island

News Flash Nassau County Ny Civicengage

Nc Property Tax Grievance E File Tutorial Youtube

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Assessment Review Commission Community Grievance Workshop Youtube